China has been the darling of the international investment universe for decades. But that’s now at risk as the troubles of over-indebted property giant China Evergrande come to a head.

The developer’s woes have been snowballing since May. Dwindling resources set against 2 trillion yuan ($305 billion) of liabilities have wiped nearly 80% off its stock and bond prices and an $80 million bond coupon payment now looms next week. Its plight has not only put in jeopardy the many hundreds of real estate projects on its books but also China’s huge property market, with potentially destabilising consequences for the banking and financial system.

What happens after those payments have been made is unclear. Bankers have said it will most likely miss the payment and go into a kind of suspended animation where authorities step in and sell some of its assets, but it could easily get messy.

”We are concerned about the spillovers to the real economy and to broader credit conditions,” said Yao Wei, Paris-based head of Asia Pacific research at Societe Generale. ”Since real estate is so central to the economy, developers’ financial difficulties can have an amplified tightening effect on credit conditions in the broader economy.”

Default Warning

Evergrande warned just over two weeks ago that it risked defaulting on its debt if it failed to raise cash. Since then it has said that no progress has been made with those efforts.

Analysts say the bigger picture is that if Evergrande – which has more than 1,300 real estate projects in over 280 cities – does topple, it will firmly dispel the idea that some Chinese firms are too big to fail.

It would probably still apply to big state-linked firms of course, but it comes after Beijing’s clampdowns on big tech firms like Alibaba and Tencent wiped nearly a trillion dollars off its markets earlier in year.

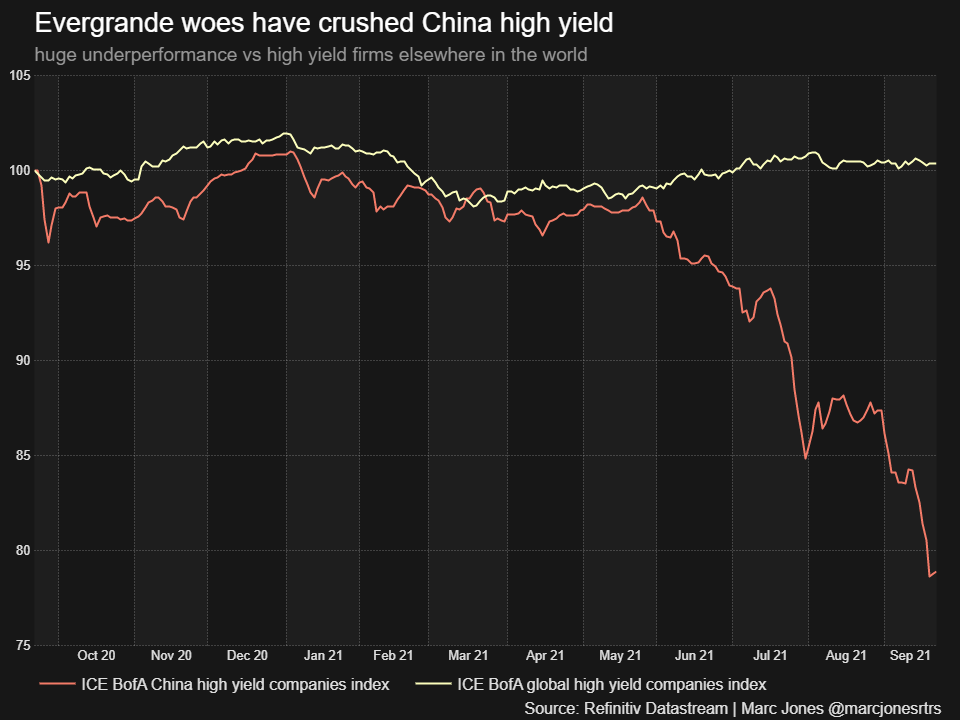

Contagion from Evergrande has largely been confined to China’s other highly-indebted “high-yield” firms which have also slumped, but Hong Kong’s heavyweight Hang Seng also hit a 10-month low on Thursday showing there is some spread.

Amundi Concern

There are big name global funds involved too. EMAXX data shows that Amundi, Europe’s largest asset manager, was the largest overall holder of Evergrande’s international bonds although it is likely to have sold at least some before things turned really ugly.

The Paris-headquartered firm had just under $93 million of a $625 million bond due for repayment in June 2025, the EMAXX data shows. UBS Asset Management was the number two holder in that issue with $85 million, as well as one of the bigger overall holders.

Amundi’s Co-Head of EM Corporate & EM High Yield, Colm d’Rosario described the fundamental picture for many Chinese firms as intact. “For now, however, we await the commencement of a restructuring process (of Evergrande) to gather more information.”

“It remains to be seen the scale of loss that investors will face.”

Global equity funds had already begun reducing their exposure to China and Hong Kong, according to an analysis of 381 funds, CBI Insights reported. It said average exposure fell to 3.8% in September from 5.1% in January. China’s regulatory crackdown on e-commerce, gaming, and education were partly blamed.

Back in April Evergrande’s bonds were trading around 90 cents on the dollar, but now they are closer to 25 cents.

“It was always priced as a risky high-yield investment but what prices are telling you today is that there was some surprise that the government would let it go fully,” the head of emerging market debt at US fund Aegon Asset Management, Jeff Grills, said.

He added it has been a text book example where investors had been lured in by the 10% plus interest rate the bonds had provided.

According to the letter Evergrande sent to the Chinese government late last year, its liabilities involve more than 128 banks and over 120 other types of institutions.

A group of Evergrande bondholders has selected investment bank Moelis & Co and law firm Kirkland & Ellis as advisers on a potential restructuring of a tranche of bonds, two sources close to the matter said.

Other funds also exposed to the bonds include the world’s biggest asset manager BlackRock, as well dozens more such as Fidelity, Goldman Sachs asset management and PIMCO.

Major US financial firms including BlackRock and Goldman, and the likes of Blackstone, were due to meet with officials from China’s central bank and its banking and securities regulators late on Thursday. News from that meeting has yet to emerge.

But debt analysts hope the damage might not be too widespread. The holdings are tiny compared to those big investment firms’ overall size. Also, only $6.75 billion of near $20 billion of Evergrande debt are included on JPMorgan’s CEMBI index, which big emerging market corporate debt buyers use as a kind of shopping list.

Others are still wary though of the wider signal it sends.

“This is part of a self-reinforcing dynamic in which rising insolvency risk sets off financial distress costs, which in turn increase insolvency risk,” Michael Pettis, a non-resident senior fellow at the Carnegie–Tsinghua Center for Global Policy, said on Twitter.

“Until regulators step in and credibly address insolvency risk across the board, conditions are likely only to deteriorate.”

Some veteran emerging market crisis watchers also think the troubles still have further to run.

“This unwind hasn’t even really started,” said Hans Humes at EM debt-focused hedge fund Greylock Capital.

- Reuters and Mark McCord

Also on AF

Unpaid Small Business Owners Despair As Evergrande Crisis Deepens

How China Evergrande’s Debt Troubles May Pose a Systemic Risk

This story was updated with a comment from an analyst in the fourth paragraph.

The post China Braces for Evergrande Fall as Spillovers Threaten Economy appeared first on Asia Financial.

0 Commentaires