(AF) As the spectre of a default looms over Evergrande, it is highly unlikely that the country’s most heavily indebted property developer will get a bailout in the traditional sense of the word, says research firm Enodo Economics in its recent note.

The firm said that local authorities will do everything in their power to delay a default and then mitigate the economic fallout.

“Those efforts will likely focus upon rescuing certain Evergrande creditors – in particular unpaid contractors and suppliers, and home buyers who have prepaid for unfinished apartments – rather than Evergrande itself,” said Dinny McMahon, the Enodo analyst who is also the author of China’s Great Wall of Debt.

Also on AF: Western Fashion Brands Brush Aside China Tirade: Chart of the Day

“As for the impact of the financial system, it’s likely to be minimal, with bondholders taking a steep haircut but the banks walking away relatively unscathed,” he added.

Last week, China’s Evergrande Group warned in its first-half earnings report that it might default on its debt, and the markets were worried that if a bailout fails to materialise it might destabilise the financial system and the broader economy.

The concern was, even if the financial system emerges relatively unscathed, an Evergrande default could affect the real economy in three direct ways:

- Homebuyers who stumped up for their apartments in advance of completion – an important fundraising tool used by all Chinese developers – won’t receive what they paid for.

- Suppliers and contractors will find themselves permanently out of pocket.

- Many of Evergrande’s projects will never be completed, affecting economic activity.

According to Enodo, efforts to address their issues will likely be led by the Guangdong and Shenzhen provincial authorities rather than the central government.

‘FREEZE ASSETS’

“Already we’ve seen local authorities taking steps to ease pressure on Evergrande. They’ve required all court cases against the developer to be centralised in Guangzhou, which will make it harder for creditors to freeze assets,” said McMahon.

Local authorities will also strive to ensure that housing projects in which people have prepaid for apartments get finished, he added.

That could mean provincial and city authorities around the country mobilise their state-owned developers to buy out Evergrande’s stake in local projects, just as state firms in Shenzhen have been doing up until now.

Beijing has dealt with a string of high-profile bailouts and corporate restructurings since the central bank took control of Baoshang Bank in early 2019.

The government has explicitly maintained a strategy of devising a solution based on the merits of each case while the authorities have worked to prevent any financial instability, according to Enodo.

However, they have strived to do so in a way that minimises both the cost to the central government and disruption to the economy. Those principles will be on display again in the treatment of Evergrande, the firm said.

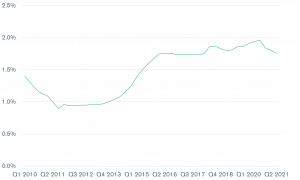

China’s non-performing loans ratio.

Source: Enodo Economics, CEIC

Finally, the authorities will likely strive to ensure that Evergrande’s contractors and suppliers get paid, McMahon said, adding: “Buying out Evergrande’s equity in certain developments will likely help toward that, but other options are available as well.”

“Consequently, it’s unlikely that the authorities will bail out the developer but they will do all they can to rescue certain creditors and limit the economic fallout,” he said.

Read more:

The Self-Made Chinese Billionaire Battling To Save Debt-Ridden Evergrande

Troubled China Evergrande Vows to Repay All Matured Wealth Management Products

The post Evergrande Not Too Big to Fail, China Can Manage Its Collapse: Enodo appeared first on Asia Financial.

0 Commentaires