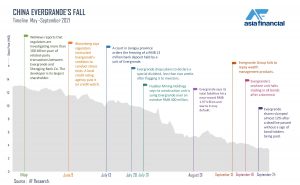

International investors were on tenterhooks as news filtered through that China Evergrande appeared to have missed a second coupon payment on an offshore bond in a week, raising concern its financial woes would spread through world markets.

Some of China Evergrande’s offshore bondholders had not received a coupon payment due by the close of Asian business on Wednesday, sources said, although the cash-strapped developer reached a $1.5-billion deal to settle a debt with a Chinese bank.

With liabilities of $305 billion, many observers fear Evergrande’s troubles will reverberate around the world – a worry that has at least eased with the Chinese central bank vowing to protect homebuyers’ interests.

The company, which has nearly $20 billion in offshore debt, was due on Wednesday to make a $47.5-million bond interest payment on its 9.5% March 2024 dollar security. It also missed an $83.5 million coupon payment on another bond last Thursday.

NO INFORMATION

The lack of clarity in the company’s latest financial trip sent its share price swinging wildly, at one point climbing as much as 5.2% and falling by as much as 7.2%. Evergrande Property Services Group fell 4.2% before trimming losses to 0.6% and China Evergrande New Energy Vehicle Group dived as much as 19.4%. It last traded down 8.6%.

Two people familiar with the matter, who declined to be named due to the sensitivity of it, said some of the holders of the 2024 bonds had received no information from Evergrande about the payment on Wednesday.

It was not immediately clear if the payment could still be made during US business hours.

A spokesperson for Evergrande did not have any immediate comment. Reuters was unable to determine whether Evergrande had told any of the bondholders what it plans to do about Wednesday’s coupon payment.

Evergrande’s silence on its offshore payment obligations since the missed payment last week has left global investors wondering if they will have to swallow large losses when 30-day grace periods end for coupons due on September 23 and September 29.

GOVERNMENT HELP

The company, once China’s top-selling developer and now expected to be one of the largest-ever restructurings in the country, has been prioritising domestic creditors over offshore bondholders.

For Evergrande, “the most likely outcome is debt restructuring with some help from the government,” Wai Hoong Leong, portfolio manager for the KraneShares Asia Pacific High Yield Bond ETF, said in a presentation to investors on Wednesday. “We expect the government and Evergrande to focus on protecting the customers and suppliers, while ensuring an orderly restructuring for creditors who are likely to take a larger impact.”

It missed the payment deadline on a dollar bond last Thursday, a day after its main property business in China said it had privately negotiated with onshore bondholders to settle a separate coupon payment on a yuan-denominated bond.

In the latest such move, Evergrande said in an exchange filing earlier on Wednesday that it would sell a 9.99 billion yuan ($1.5bn) stake it owns in Shengjing Bank to a state-owned asset management company.

The bank, one of Evergrande’s main lenders, demanded all net proceeds from the sale go towards settling the developer’s debts with Shengjing. As of the first half last year, the bank had 7 billion yuan in loans to Evergrande, according to a report by brokerage CCB International, citing news reports.

LIQUIDITY STRUGGLE

The move highlights the role state-owned enterprises may play in Evergrande’s denouement.

“We are in the wait-and-see phase at the moment. The creditors are organising themselves and people are trying to figure out how this falling knife might be caught,” an adviser hired by one of the offshore Evergrande bondholders said.

“The clock has started to tick on a restructuring process. The company is going to need to do something, it’s obviously struggling with liquidity … the liquidity issue is what brings the house of cards down.”

Once the face of China’s frenzied building boom, Evergrande has now become the poster child for a crackdown on developers’ debts that has spurred volatility in global markets and left large and small investors sweating on their exposure.

Evergrande’s troubles slammed global stock markets earlier this month, although some global investors have since shifted their focus to political wrangling in Washington over the US debt ceiling and a rise in Treasury yields that has pressured stocks.

GOVERNMENT PRODDING

Nonetheless, any negative surprise from Evergrande could give stock market bears more ammunition.

Rating agency Fitch on Wednesday downgraded the long-term foreign-currency issuer default ratings (IDRs) of Evergrande and its subsidiaries, Hengda and Tianji, citing likely non-payment of offshore bond interest last week.

Another report on Wednesday said that Marathon Asset Management is buying debt issued by Evergrande Group, citing the investment firm’s co-founder and chief executive officer, Bruce Richards.

Beijing is prodding government-owned firms and state-backed property developers such as China Vanke to purchase some of Evergrande’s assets, people with knowledge of the matter told Reuters.

Authorities are hoping that asset purchases will ward off or at least mitigate any social unrest that could occur if Evergrande were to suffer a messy collapse, they said, declining to be identified due to the sensitivity of the matter.

On Monday, China’s central bank vowed to protect consumers exposed to the housing market, without mentioning Evergrande in a statement posted to its website, and injected more cash into the banking system.

Those moves have boosted investor sentiment towards Chinese property stocks in the last couple of days, with Evergrande stock rising as much as 17% on Wednesday before closing 15% higher.

• Reuters with additional editing by Mark McCord

Also on AF

Evergrande Shares Surge on Bank Sale as Payment Deadline Looms

The post Investors Hold Their Breath as Evergrande Set to Miss Second Coupon Payment appeared first on Asia Financial.

0 Commentaires