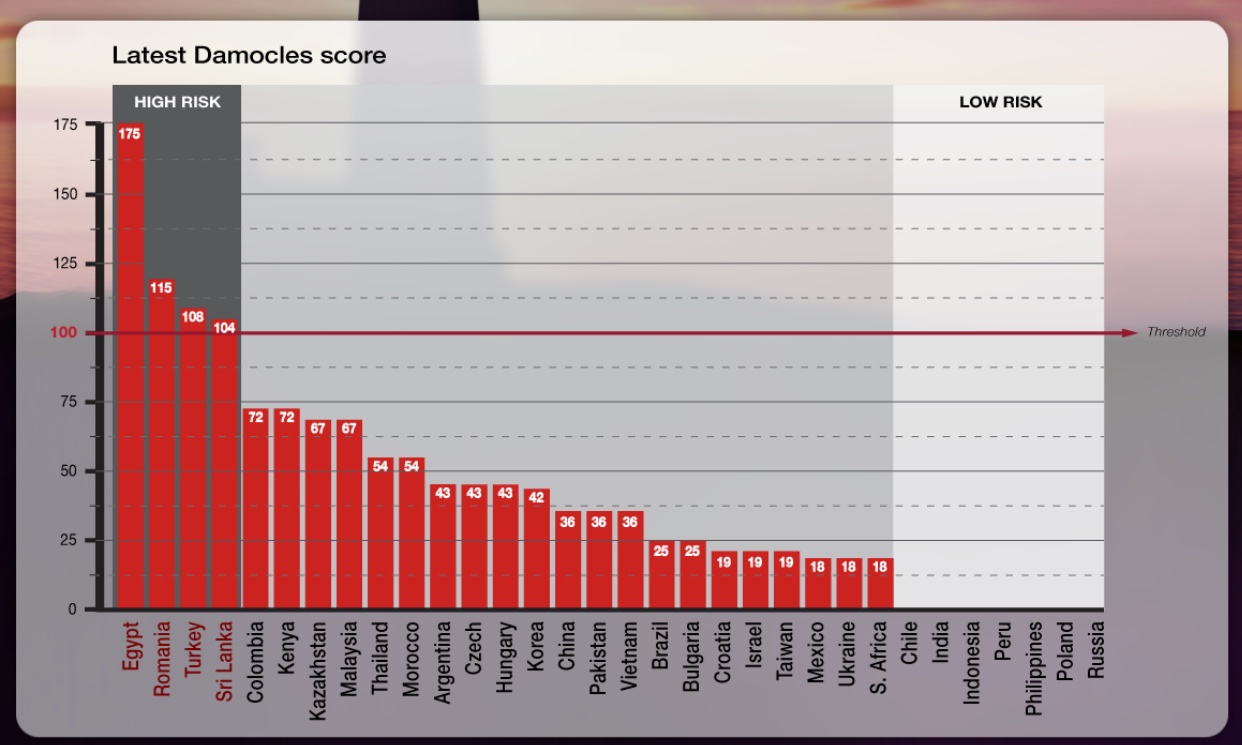

Sri Lanka is the developing Asian nation most likely to face an exchange-rate crisis, while China, India, Indonesia and the Philippines fell into the lowest-risk categories, according to new research by Nomura.

The brokerage said the South Asian island nation, along with Egypt, Romania and Turkey, is highly vulnerable despite inflows of International Monetary Fund SDR allocations.

Nomura assessed the risk of exchange rate crises for 32 emerging market economies, claiming that its methodology signalled, up to 12 months in advance, 64% of the past 61 exchange rate crises since 1996.

The system, named Damocles, scores markets numerically. When a country’s score exceeds 100, it should be interpreted as a warning that the country is vulnerable to an exchange rate crisis.

At the other end of the spectrum, 13 of the 32 EM countries have low Damocles scores of below 20, signalling very low risk of a currency crash. “This highlights the current high degree of heterogeneity in EM economic fundamentals,” Nomura said.

Despite several countries with low scores, the sum of the scores for the 32 countries has increased compared with the previous update in February – rising in 11 countries and falling in only five – indicating a rise in overall EM exchange rate risk.

“In some respects EM is in better shape than on the eve of the 2013 taper tantrum; it now has smaller current account deficits (or surpluses) and larger foreign exchange reserves,” Nomura noted.

“But the pandemic has given rise to new sources of EM vulnerability, including chronically weak economic recoveries,” it added.

Damocles Index

Real gross domestic product in many EMs is only just starting to recover to pre-pandemic levels, while Nomura also observed a marked deterioration in fiscal finances and sharply higher inflation that, even with recent policy rate hikes, has kept real interest rates negative in most EM countries.

The prospect of the Fed normalising monetary policy amid China’s deepening economic downturn is not a particularly good combination for EM, Nomura said, adding that three other vulnerabilities “lurked in the shadows” – a growing EM bank-sovereign debt nexus, looming twin deficit challenges and a potential EM food crisis.

“The Damocles index comprises eight indicators that we found to be the best predictors of the 61 exchange rate crises in our sample of 32 EM countries, with data back to 1996,” Nomura said.

It includes six single indicators – import cover, short-term external debt/exports, FX reserves/short-term external debt, broad money/FX reserves, real short-term interest rate, non-FDI gross inflows less the change in FX reserves – and two joint indicators – fiscal and current accounts, and current account and real effective exchange rates.

READ MORE:

China’s Currency Dips After Regulator Hints at Intervention

Yuan Looking to Overtake the Pound and Yen in Forex Trade

The post Sri Lanka Most At Risk From Exchange Rate Crisis: Nomura appeared first on Asia Financial.

0 Commentaires